The concept of retirement has changed dramatically in the decades since the introduction of the 401(k), which has transformed the way that people think about and plan for retirement. It has largely replaced defined benefit plans and become the de facto source of retirement funding for many employees. Its creators, however, intended for the 401(k) to be a supplement to employee pensions, not a wholesale replacement.

Some experts believe that the 401(k) is failing as a solution for a financially secure retirement. Even in combination with Social Security, the typical amount of individual retirement savings most families have managed to accumulate will not be enough to support a comfortable standard of living, particularly with the average lifespan continuing to increase. Millions of Americans are facing the prospect of living in poverty after a lifetime of working.

Some experts believe that the 401(k) is failing as a solution for a financially secure retirement. Even in combination with Social Security, the typical amount of individual retirement savings most families have managed to accumulate will not be enough to support a comfortable standard of living, particularly with the average lifespan continuing to increase. Millions of Americans are facing the prospect of living in poverty after a lifetime of working.So it’s no secret that Americans are facing a retirement crisis. Based on current trends, Americans will be confronting rates of elder poverty in the not-too-distant future that haven’t been seen since the Great Depression of the 1930s. Professor Teresa Ghilarducci estimates that of the 18 million workers who were between ages 55 and 64 in 2012, 4.3 million are projected to be poor or near-poor when they turn 65, including 2.6 million who were part of the middle class before reaching retirement age.

Individual retirement accounts, including 401(k)s, make up the bulk of retirement savings in the US. The Retirement Income Deficit (RID) calculates the gap between what American households have actually saved and what they need to have saved to maintain the same standard of living in retirement. The RID is calculated based on data collected from the Federal Reserve’s Survey of Consumer Finances. According to the Center for Retirement Research at Boston College, as of 2015 the nation’s RID has risen from $6.6 trillion in 2010 to $7.7 trillion.

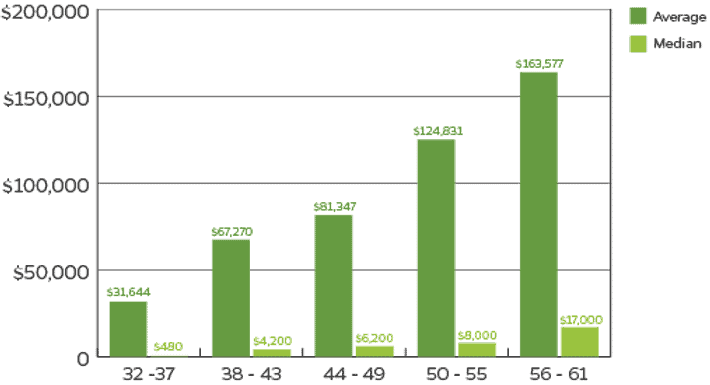

From an individual perspective, the data on the amount of retirement savings accumulated by families of working age (31-61 years old) is even more disturbing, as summarized in the chart below. It shows the contrast between the average and median amount of retirement savings for Americans by age group. Younger individuals and families will have had less time to save so their totals will be less, and those who are older would be expected to have saved more and have those savings compounded.

When a dataset has a wide range of values from high to low, the average can be misleading as a measure and paints an overly rosy picture. In this case, the average appears to be relatively high because a minority of high income families (about 20%) have accumulated a large amount of savings for retirement, while the majority of middle or low income workers (the remaining 80%) have saved little or nothing at all. The median, the number at which half the population is above and the other half is below, tells a very different story.

Families’ Average and Median Retirement Savings by Age Group, 2016

Source: Data from the Economic Policy Institute

At age group 32-37, the average amount of retirement savings is $31,644. The median is only $480–not enough to even show up on the chart. By age 56-61, the average is $163,577. But the median retirement savings for families is just $17,000—an amount that is barely above the 2018 federal poverty level of $16,460 in annual income for a two person household. Spread out over 20 to 30 years of retirement, $17,000 won’t go very far. Total retirement savings for single individuals and women are even less. And as 8,000 to 10,000 Americans turn 65 every day, nearly half of Americans have no retirement savings at all.

As participant contributions to employer-sponsored retirement plans have stagnated or declined in recent years, financially stressed employees are increasingly turning to their employers for help. In response, employers are looking to provide financial wellness resources as part of their benefits package, especially given the significant cost of financially stressed employees in terms of lost productivity and absenteeism. The bottom line? Employees who are not meeting or barely keeping up with their immediate financial needs cannot save for retirement. Retirement plan advisors seeking to remain competitive, retain existing plans, and win new business need to include a comprehensive financial wellness solution as part of their plan offering.