Maximize Your Financial Growth

Investment Planning

Explore the potential of a well-structured savings and investment plan with Questis, designed personally for your financial success and growth.

Questis can unlock the full potential of your investment plan.

Harnessing Financial Opportunities

A savings and investment plan is crucial in building a secure financial future. It’s not just about setting money aside; it’s about strategically growing your wealth. With the right plan, you can turn your savings into significant investments, ensuring long-term financial stability and growth. This plan empowers you to meet life’s milestones, like buying a home or planning for retirement, while offering flexibility to adjust to life’s changes. Planning enables you to prepare today to handle unexpected events enabling you to better achieve long-term goals.

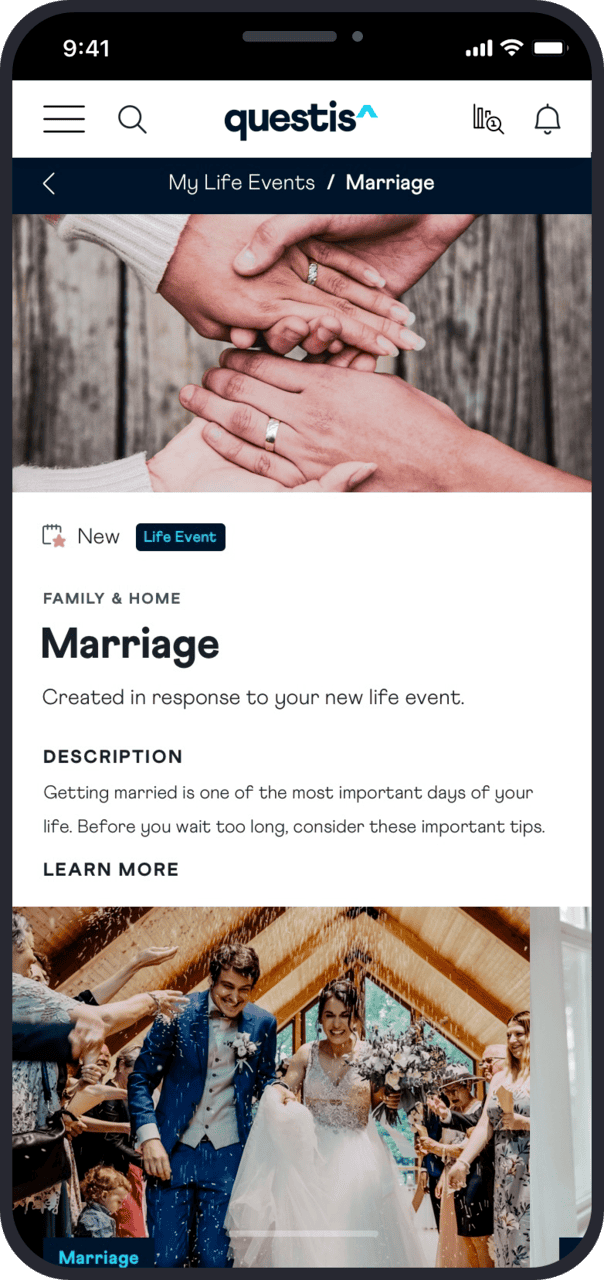

Questis App: Tailored Support for Your Plan

^

The Questis app offers personalized coaching and cutting-edge tools, simplifying the process of managing your savings and investment plan.

With one-on-one coaching opportunities, you can explore different investment avenues, understand market trends, and receive advice tailored to your individual needs. This app acts as though it were your personal financial coach, helping you navigate through the complexities of investing and saving with ease. Our platform continuously evolves to meet your changing needs.

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

Inform Your Employer About Questis^

Your Route to Effective Savings

- Spending – Wise Spending Choices, Understanding Credit, Budgeting for Credit Health, Minimizing High-Interest Debts

- Protection – Credit Fraud Prevention, Identity Theft Protection, Regular Credit Checks, Secure Financial Transactions

- Debt – Efficient Debt Management, Timely Bill Payments, Reducing Credit Balances, Debt-to-Income Ratio Improvement

- Save – Building Emergency Funds, Savings to Reduce Debt, Credit Stability, Saving to Avoid High-Credit Utilization

Questions?

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.