Prioritizing Your Financial Future

Retirement Planning Advice

Questis can help as you work and save towards the goal of a secure retirement. Accessing our comprehensive tools, resources and support helps you plan the retirement you desire.

Secure Your Retirement

Charting Your Course to Retirement

Effective retirement planning is key to a comfortable and worry-free future. Questis provides employees and individuals with tailored solutions and resources to help them prepare for this significant life milestone. Our approach involves understanding your retirement goals, assessing your current financial situation, and developing a comprehensive plan to achieve your objectives. Whether you’re just starting your career or nearing retirement, we focus on devising strategies that mean being able to enjoy your golden years free from financial stress and full of opportunities.

Questis: Simplifying Retirement Preparation^

With Questis, you have tools, resources and support that enable you to be more effective in planning for retirement, ensuring a future that’s both financially secure and personally rewarding.

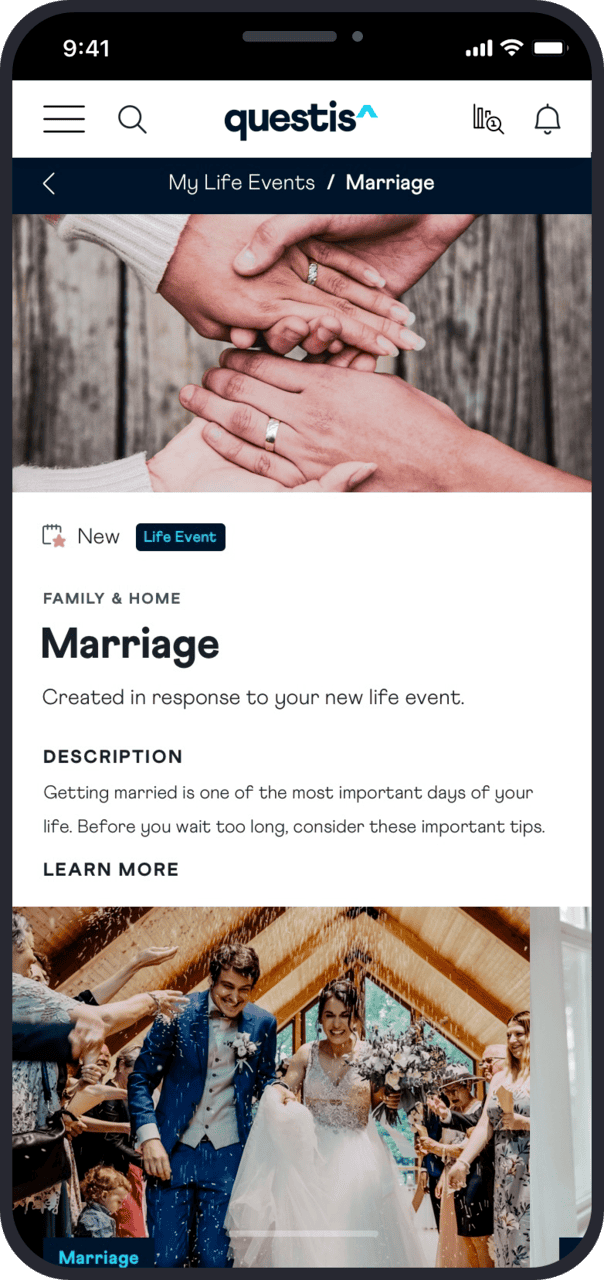

The Questis app is a valuable tool in your retirement planning arsenal, offering features for savings tracking, financial forecasting, and accessing retirement planning. With intuitive design and user-friendly interfaces, the app makes planning for retirement accessible and manageable to everyone. It will empower you to take proactive steps towards your ideal retirement in a way that suits you.

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

Inform Your Employer About Questis^

Your Road to Retirement Mastery

- Spending – Wise Spending Choices, Understanding Credit, Budgeting for Credit Health, Minimizing High-Interest Debts

- Protection – Credit Fraud Prevention, Identity Theft Protection, Regular Credit Checks, Secure Financial Transactions

- Debt – Efficient Debt Management, Timely Bill Payments, Reducing Credit Balances, Debt-to-Income Ratio Improvement

- Save – Building Emergency Funds, Savings to Reduce Debt, Credit Stability, Saving to Avoid High-Credit Utilization

Questions?

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.