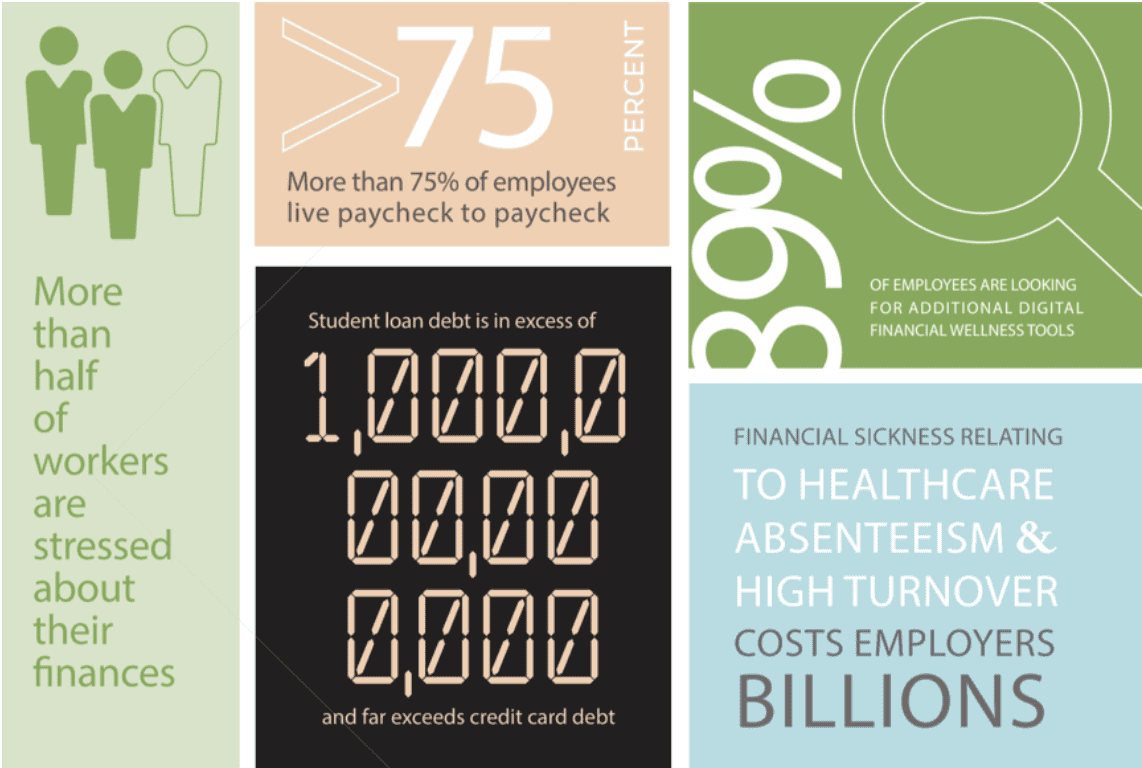

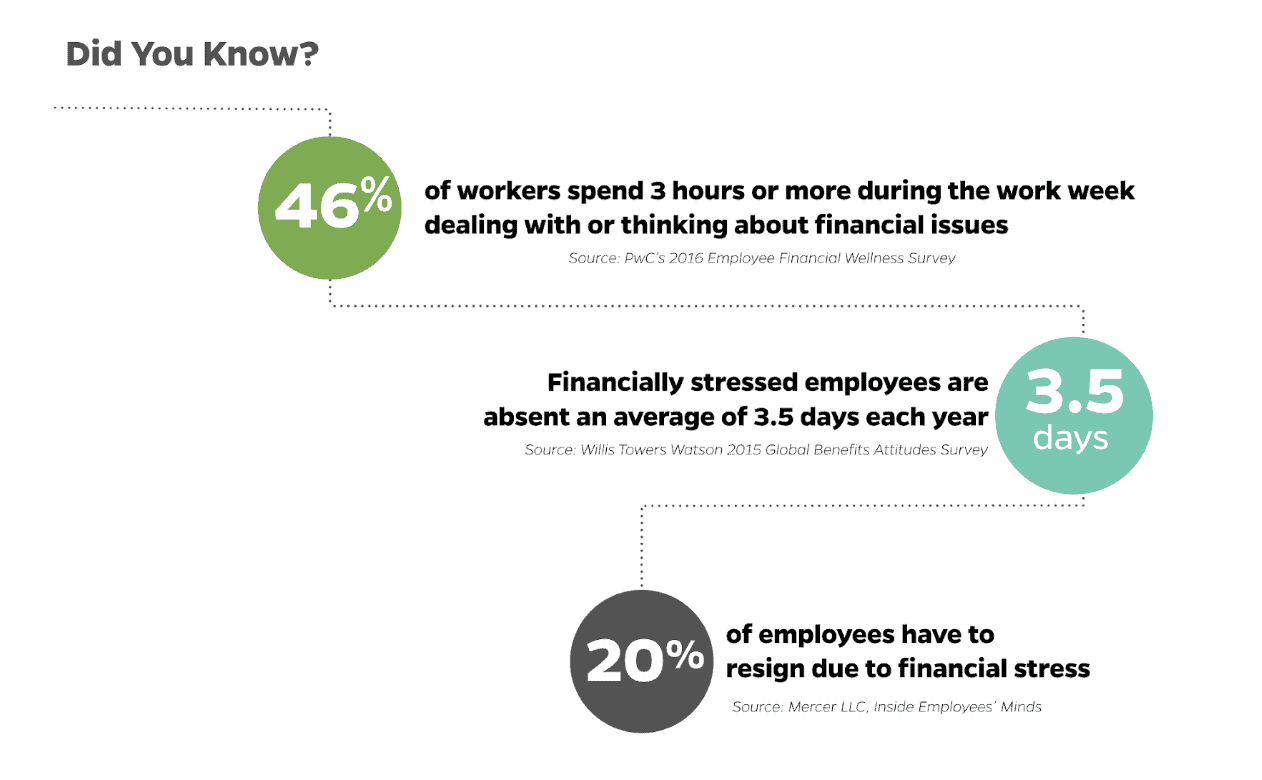

Studies show employers who offer wellness benefits to employees see an increase in efficiency in the workplace, in addition to higher levels of productivity and satisfaction. More than 50% of people indicate that they are stressed about their finances and slightly less spend between one and three hours weekly distracted by their finances at work. Financial education alone is no longer considered an adequate solution and with both Boomers and Gen Xers inching closer to ‘normal’ retirement age, it’s time we think about this problem differently — along with a viable solution.

According to PwC’s latest wellness survey, 25 percent of respondents said access to unbiased financial guidance is the employee benefit they most desire. That’s one quarter of people who are asking for financial wellness. Additionally, 90% of people are already looking for financial help outside the workplace. By giving people what they seek, i.e. access the tools and resources they need to make sound financial decisions, people can be empowered to make and stick to realistic financial plans.

These benefits, while great for employees and their familiars, can also be profitable for employers. Financially stressed workers are absent from work on average 3.5 days per year, according to Willis Towers Watson. That’s $3500 per person per year in time alone for a company with a blended hourly rate of $125. Turnover costs are staggering, and, as previously mentioned, people who are financially worried are spending work hours addressing their issues. In fact, according to the Mercer LLC Inside Employees’ Minds report, 20% of people resign due to their financial stress. Financial wellness benefits and effective programs encourage employees to take action, so that they can be more focused, present, and healthy — mentally and physically. An effective, authentic program people engage with also encourages company tenure, thereby decreasing turnover and its associated costs.

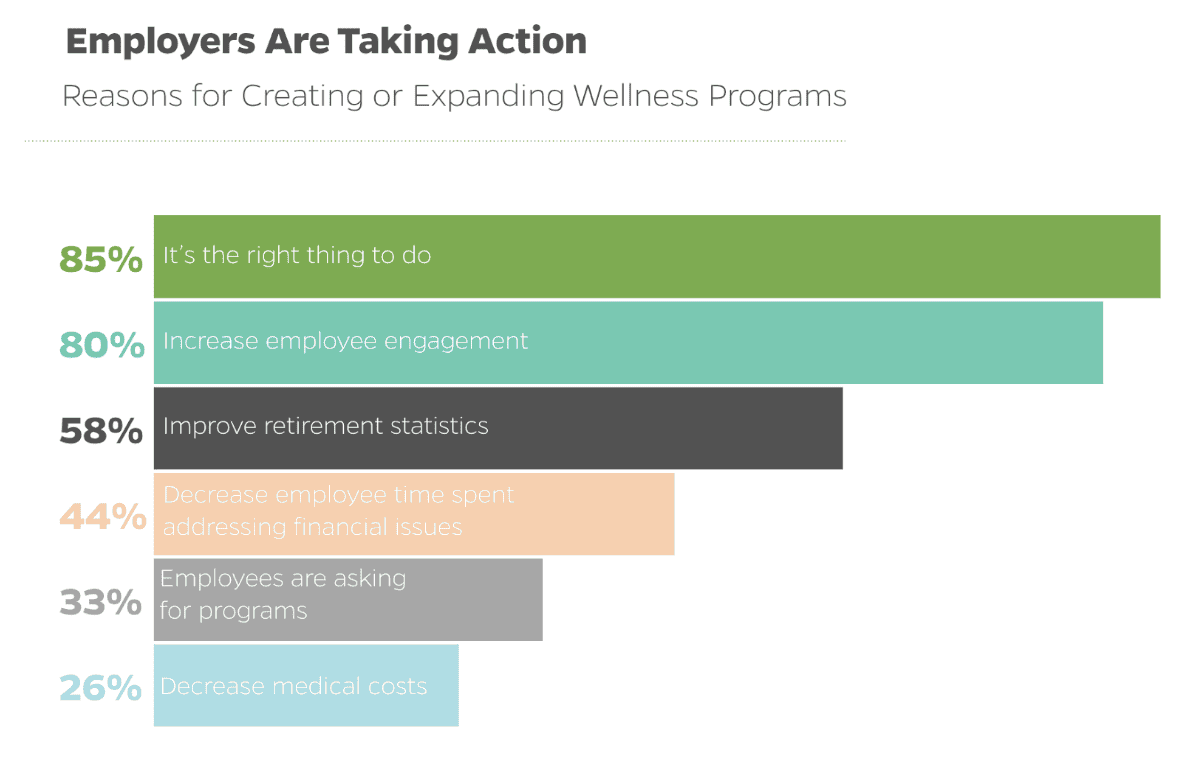

Employers are rapidly adding financial wellness programs to benefits packages. Beyond fiscal drivers like decreasing the cost of medical expenses and reducing presenteeism, employers are motivated to offer effective programs because, according to PWC, close to 90% of employees are asking and because it’s the right thing to do.

Positioning Financial Wellness

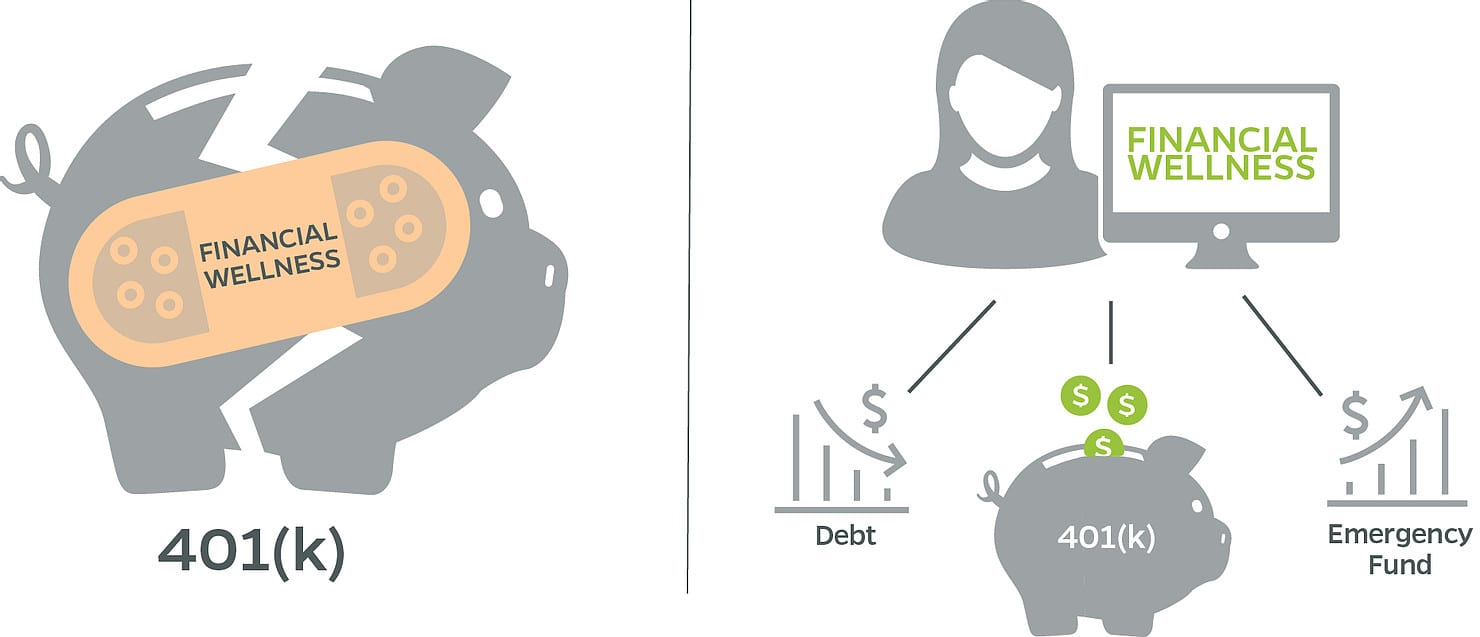

In recent years, financial wellness programs have been positioned and sold as a bolt-on solutions to 401k plans. A check in the box, an upsell — which makes exactly zero sense if you look closely at the history of the 401k. When people live paycheck to paycheck, and according to PWC over 75% of Americans do, they literally cannot contribute to their retirement plans. And they aren’t. The median retirement savings for Americans age 46-51 is only $17,000. We need to help people address their short term financial issues so that they can have the opportunity to prepare for retirement. Financial wellness programs are the infrastructure that can power this behavior change and help people make progress to meet their financial goals, including retirement.

How Do We Do That? Meet People Where They Are

When building a roll out plan for a financial wellness offering, it’s important that plan participants are top of mind. Be strategic about this offering and remember that content and information access alone do not behavior change make. Financial wellness programs need to have champions, advocates, experts, and consistent targeted messaging to be impactful and drive adoption.

People who need help often hesitate to ask for it or to take full advantage of the benefits offered to them. It is important when developing a successful program to take special care to meet people where they are. That means educating them on the value of the program, what it could mean for them in concrete terms, how it works, and what they need to do to reap the full benefits. We need to simplify personal finance so that people understand, act, and consistently engage.

ROI: Track Progress

As more and more employers offer and implement financial education programs, they must have a way to record and track progress. Everyone wants to know the ‘ROI of financial wellness,’ after all.

By setting goals and benchmarks at the onset of program deployment, plan advisors, plan sponsors, and plan participants alike can track behavior, activity, and progress. Financial wellness technology platforms make this possible. With qualitative surveys, account aggregation, budgeting and cashflow tools, advisor access, and more, participants have the tools, educational content, and human expert access they need to create a viable plan and stick to it through goal completion. A truly comprehensive financial wellness toolbox is supported by a digital financial wellness technology foundation.

To learn more about how Questis Financial Wellness Technology is changing the way the world looks at financial wellness, contact us.