Personalize Your Financial Journey

1 on 1 Financial Coaching

Dive into the world of personalized financial coaching with Questis, where your unique financial goals are our top priority.

Personalized Coaching for Empowerment

Tailoring Your Financial Future

One-on-one financial coaching offers a tailored approach to managing your finances in the context of your unique lifestyle and goals. Questis provides this personalized service, understanding that each individual has different financial needs and aspirations. This type of coaching is empowering, allowing you to take control of your finances with confidence. It offers a focused environment to discuss your financial concerns and goals, and receive advice specifically suited to your situation. This personalized approach ensures that every employee’s financial plan is as unique as they are, crafted to suit their one-of-a-kind life objectives.

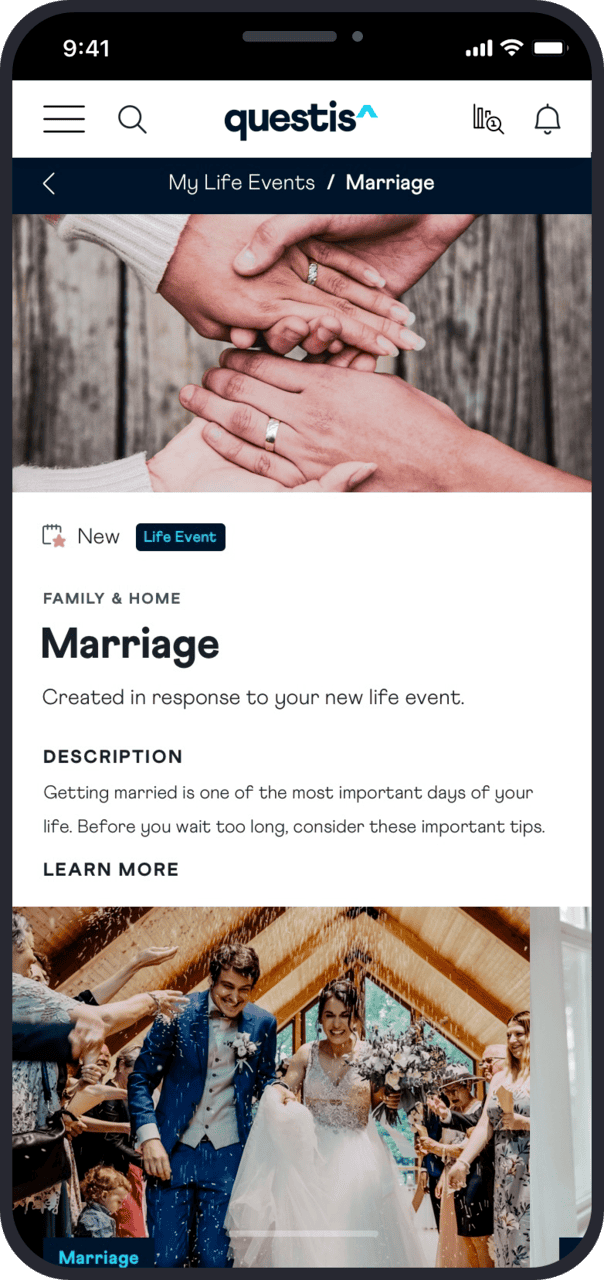

Questis App: Support at Your Fingertips ^

Our 1 on 1 financial coaching service is designed to bring clarity and control to your financial life.

The Questis app offers an additional layer of personalized support for your 1 on 1 financial coaching journey. This dynamic tool provides access to coaching opportunities, financial tracking, and tailored advice, all easily manageable from your device. The app complements your individual sessions, offering continuous support and resources to reinforce your personalized financial strategies.

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

Inform Your Employer About Questis^

Your Route to Effective Savings

- Spending – Wise Spending Choices, Understanding Credit, Budgeting for Credit Health, Minimizing High-Interest Debts

- Protection – Credit Fraud Prevention, Identity Theft Protection, Regular Credit Checks, Secure Financial Transactions

- Debt – Efficient Debt Management, Timely Bill Payments, Reducing Credit Balances, Debt-to-Income Ratio Improvement

- Save – Building Emergency Funds, Savings to Reduce Debt, Credit Stability, Saving to Avoid High-Credit Utilization

Questions?

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.