Beyond salaries and traditional benefits

Transform Your Employer Value Proposition^

In the competitive landscape for talent, a compelling employer value proposition is more critical than ever. Modern professionals seek workplaces that offer holistic support for their well-being, including their financial health. Questis sets your organization apart, offering a comprehensive suite of financial wellness tools and personalized support, thereby enhancing your reputation as a supportive and forward-thinking employer.

Enhance Your Employer Value Proposition with Questis^

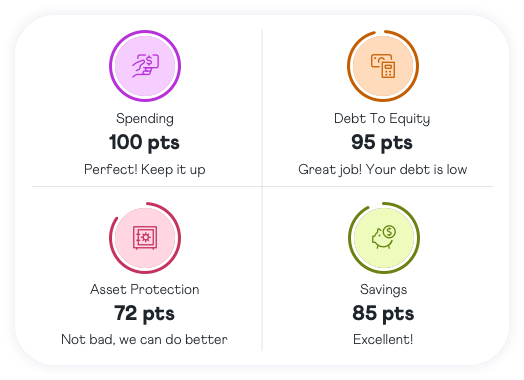

1. Tailored Financial Health Assessments

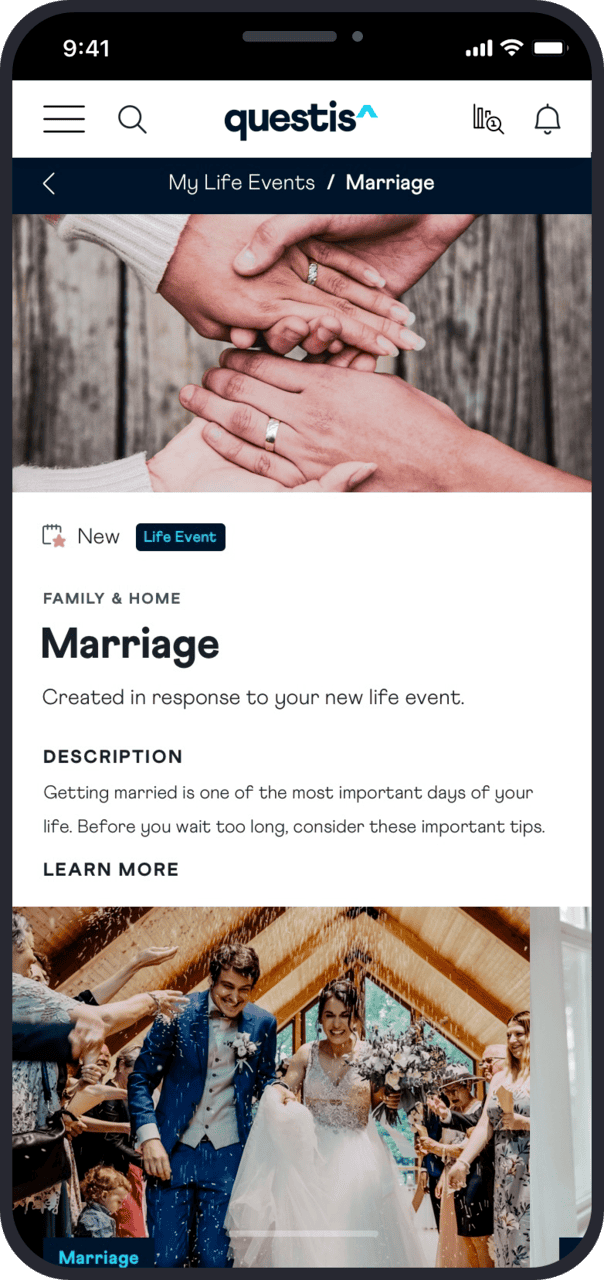

Begin with deep-dive assessments for each employee, laying the groundwork for personalized financial wellness strategies that resonate with individual needs and goals. This process helps identify specific areas where employees can improve their financial health, ensuring targeted and effective support.

2. Expansive Financial Education

Unlock access to an extensive library of financial topics, enabling employees to gain crucial knowledge in managing debts, understanding investments, and planning for retirement, thereby fostering financial literacy and empowerment. Such education equips employees to make more informed decisions about their finances, enhancing their overall financial well-being.

3. Automated Savings and Budgeting Tools

Implement cutting-edge tools that automate savings and help employees manage their budgets more effectively, instilling a sense of financial control and security. These tools simplify the financial planning process, making it easier for employees to achieve their savings goals.

4. Personalized Investment Guidance

Connect employees with financial experts for tailored investment advice, supporting their journey towards building a robust financial portfolio. This guidance demystifies the investing process, helping those you employ to grow their wealth.

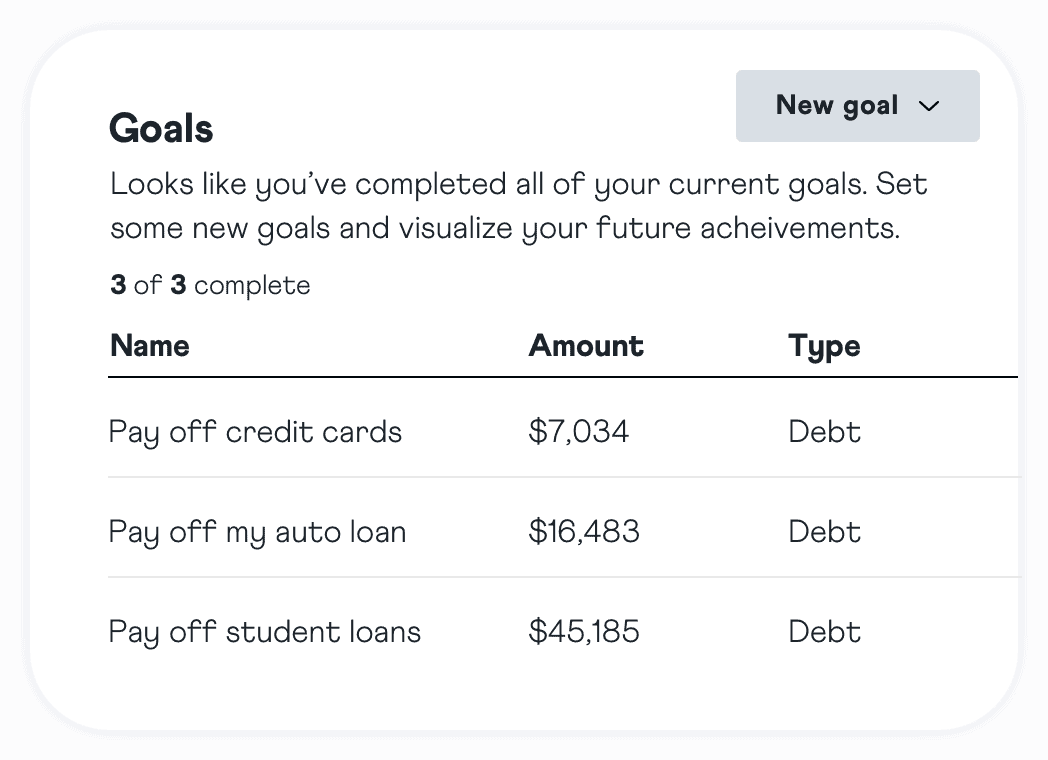

5. Comprehensive Debt Management

Offer dedicated programs and resources aimed at helping employees tackle debt, from student loans to credit cards, alleviating one of the primary sources of financial stress. These programs provide strategies for debt reduction and management, offering a clearer path to financial freedom.

6. Future-focused Retirement Planning

Facilitate forward-looking retirement planning sessions and resources, ensuring employees can envision a secure financial future within your organization. This planning empowers employees to take proactive steps towards securing their retirement, contributing to long-term financial security and satisfaction.

Upgrade Your Culture With a True Employer Value Proposition^

Questis’s approach goes beyond mere benefits, embedding financial wellness into the fabric of your organization’s culture.

Goal-Oriented Financial Planning

Assist employees in setting and achieving personalized financial milestones, directly impacting their engagement and loyalty.

Emergency Fund Strategies

Provide expert guidance on establishing robust emergency funds, preparing employees for life’s uncertainties without impacting their job security.

Diverse Insurance Protections

Through Questis, offer access to an array of insurance options, from health to life and disability, safeguarding employees’ financial well-being against unforeseen challenges.

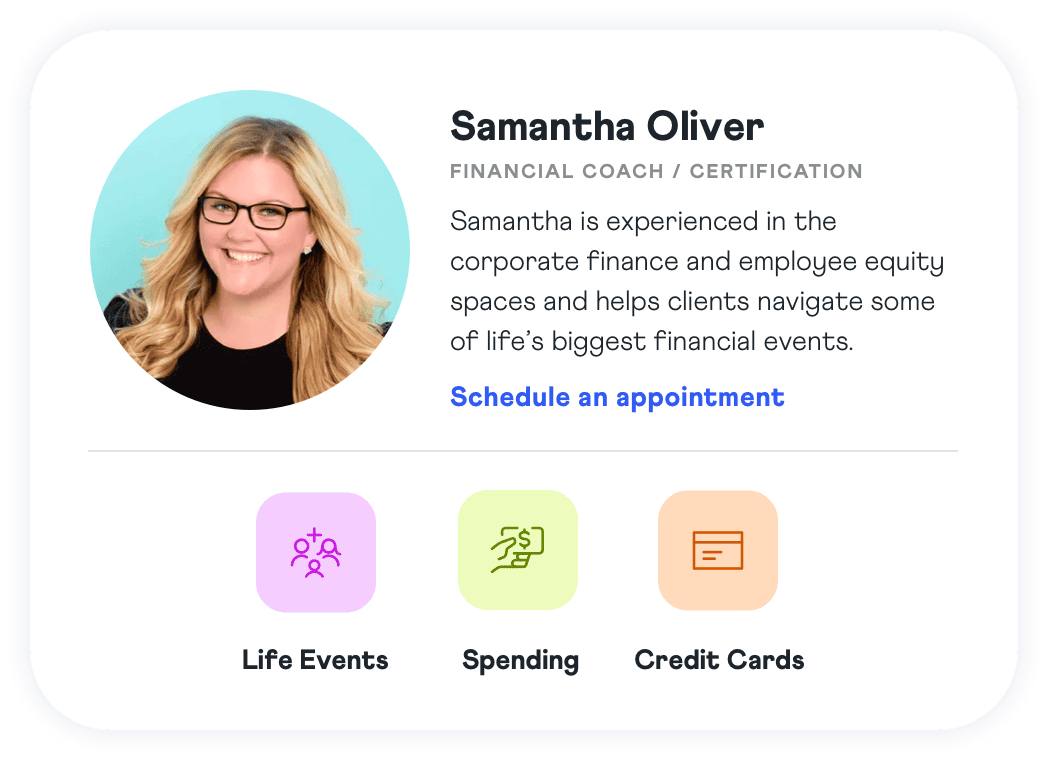

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

How Questis Transforms Employer Value Propositions^

A Comprehensive Financial Wellness Ecosystem

Integrating Questis into your employer value proposition will transcend the provision of mere financial tools because it will foster a nurturing ecosystem designed to support every employee’s financial prosperity. Our holistic method not only tackles immediate fiscal challenges—such as managing unexpected expenses or reducing high-interest debt—but also paves the way for enduring financial health. This approach ensures that individuals at all levels, from entry-level to executives, have the resources and support needed to navigate their financial landscapes successfully, fostering a culture of financial confidence and well-being across the organization.

Cultivating a Financially Empowered Workforce

By prioritizing financial wellness, Questis helps cultivate a workplace environment that deeply values and supports every aspect of employee well-being. This environment not only attracts forward-thinking individuals seeking employers who genuinely care but also retains them by proactively adapting to and meeting their evolving financial needs with innovative solutions like emergency funds, financial education programs, and personalized financial planning services

Strengthening Bonds Through Financial Security

Questis significantly strengthens the bond between employer and employee by demonstrating a vested interest in the financial security and satisfaction of your workforce. This ever-deepening commitment, underscored by offering resources like debt management advice, investment planning, and savings strategies, is a powerful component of any business’s employer value proposition. It will amplify your organization’s appeal, making it a magnet for both existing talent and prospective employees drawn to a culture that champions financial empowerment and personal growth.

Empower Your Enteprise’s Future With Enhanced Financial Wellness

Incorporating Questis into your employer value proposition is a strategic move towards creating a more attractive, supportive, and empowering workplace. By focusing on financial wellness, you signal to current and prospective employees that your organization is committed to their success and well-being, positioning yourself as a preferred employer in a competitive market.

Questions?

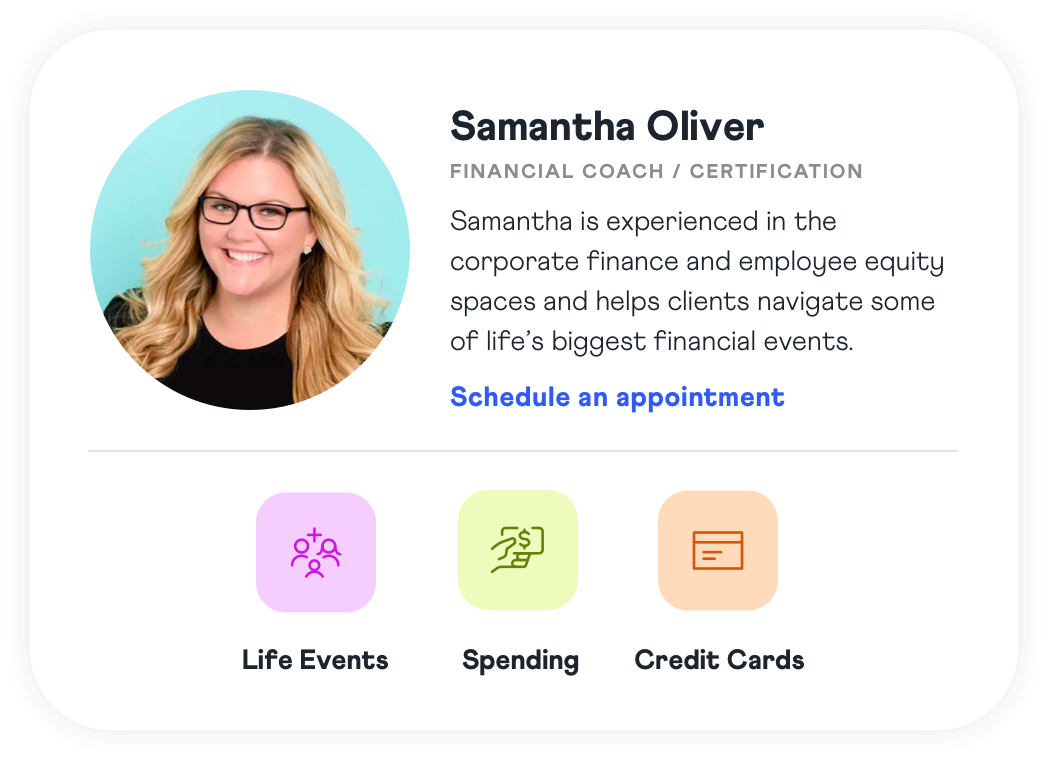

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.