Your Pathway to Financial Liberation

Paying Off Credit Card Debt:

Embark on a journey with Questis to conquer credit card debt and reclaim your independence through financial empowerment.

Break Free from Credit Card Debt

Eradicating Credit Card Debt, Empowering Lives

Credit card debt can be a significant barrier to financial freedom, but with the right strategies, it can be overcome. Questis provides comprehensive support from our expert coaches to help employees pay off their credit card debt in a manageable way. Our approach focuses not only on clearing current debts but also on preventing future debt accumulation. By tackling credit card debt head-on, you can reduce financial stress, improve your credit score, and create a healthier financial environment for yourself. Paying off credit card debt is also about regaining control over your finances and laying the groundwork for a debt-free future.

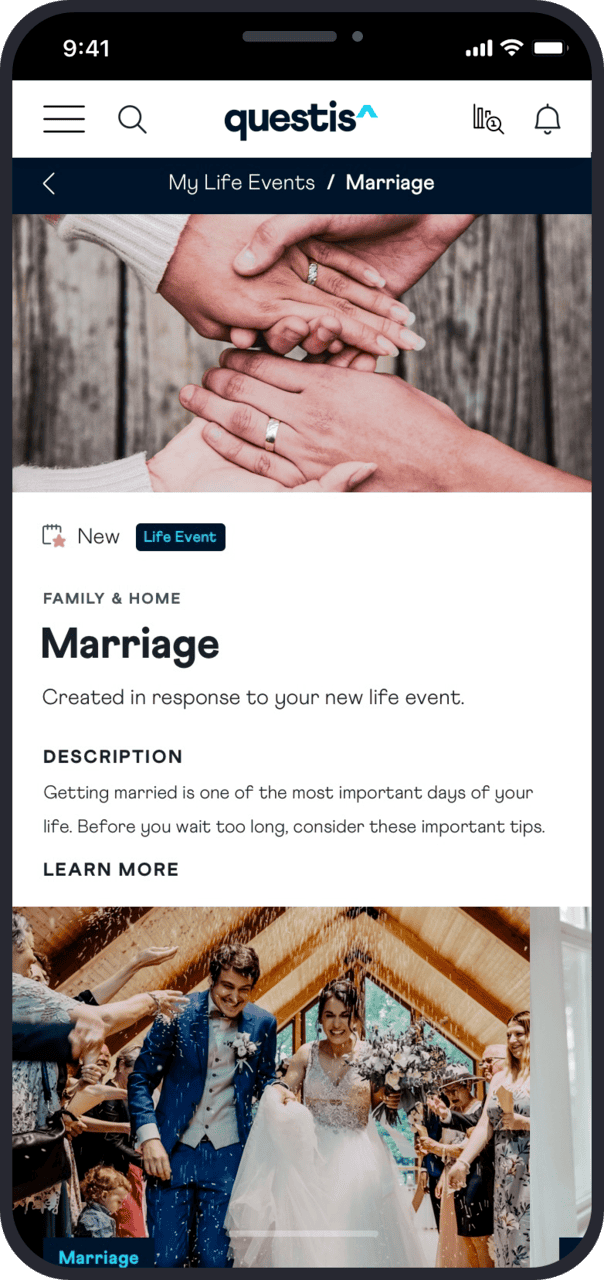

Questis: Your Debt Management Companion ^

Let Questis guide you through effective strategies to pay off credit card debt, paving the way to a more secure financial future with fewer worries.

The Questis app provides real-time debt management tools and resources at your fingertips. Track your debt repayment progress, access personalized advice, and utilize budgeting tools to efficiently manage your finances when paying off credit card debt.

See how coaching helped Sophia with her financial goals

Sophia, a struggling 35 year old paid off $25,000 of debt and saved an $8,000 emergency fund with the help of her Questis Financial Empowerment Coach.

Inform Your Employer About Questis^

Your Roadmap to a Debt-Free Life

- Spending – Wise Spending Choices, Understanding Credit, Budgeting for Credit Health, Minimizing High-Interest Debts

- Protection – Credit Fraud Prevention, Identity Theft Protection, Regular Credit Checks, Secure Financial Transactions

- Debt – Efficient Debt Management, Timely Bill Payments, Reducing Credit Balances, Debt-to-Income Ratio Improvement

- Save – Building Emergency Funds, Savings to Reduce Debt, Credit Stability, Saving to Avoid High-Credit Utilization

Questions?

See coaching in action^

Schedule a 20-minute session with our Head of Coaching by selecting

“tell me more about coaching” in the contact form.